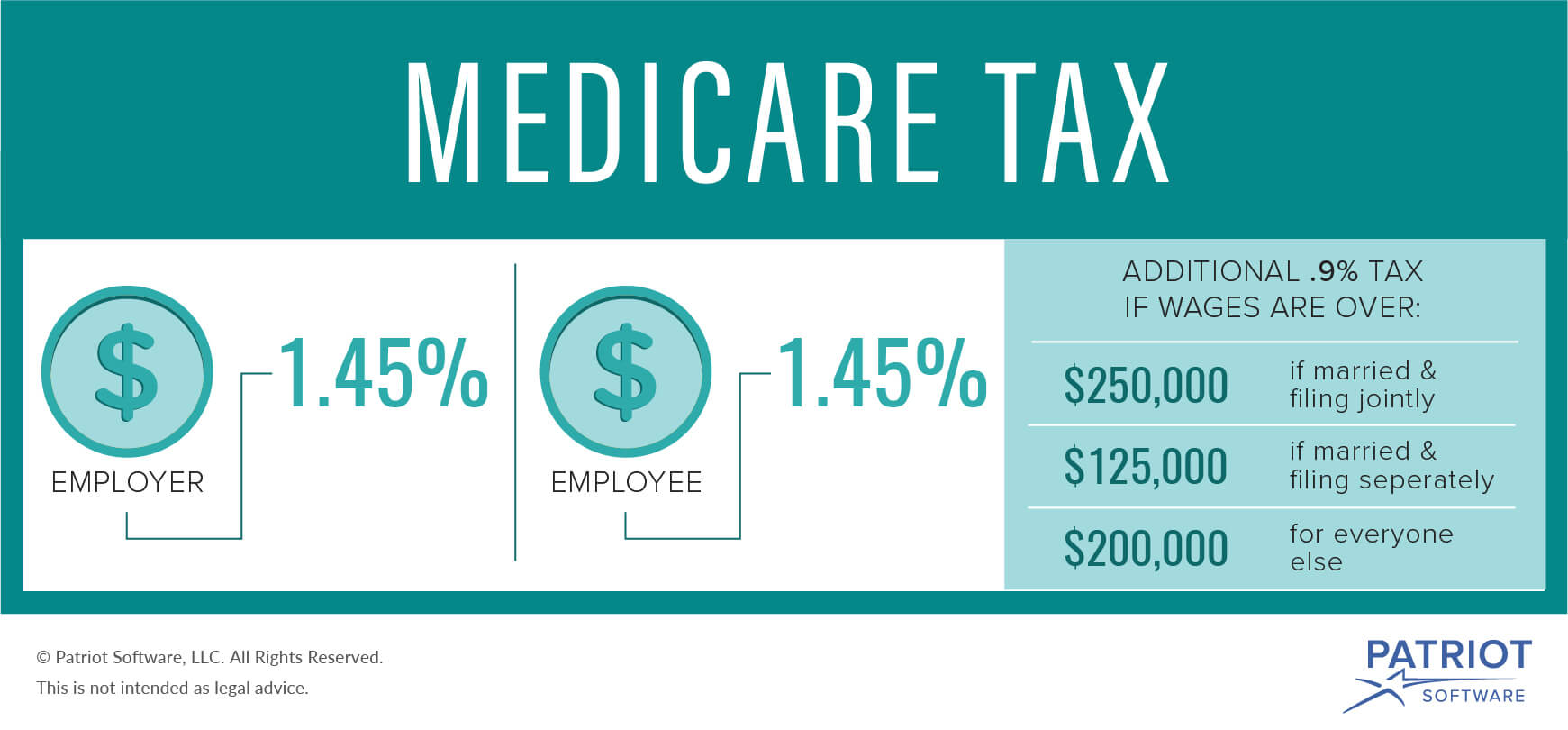

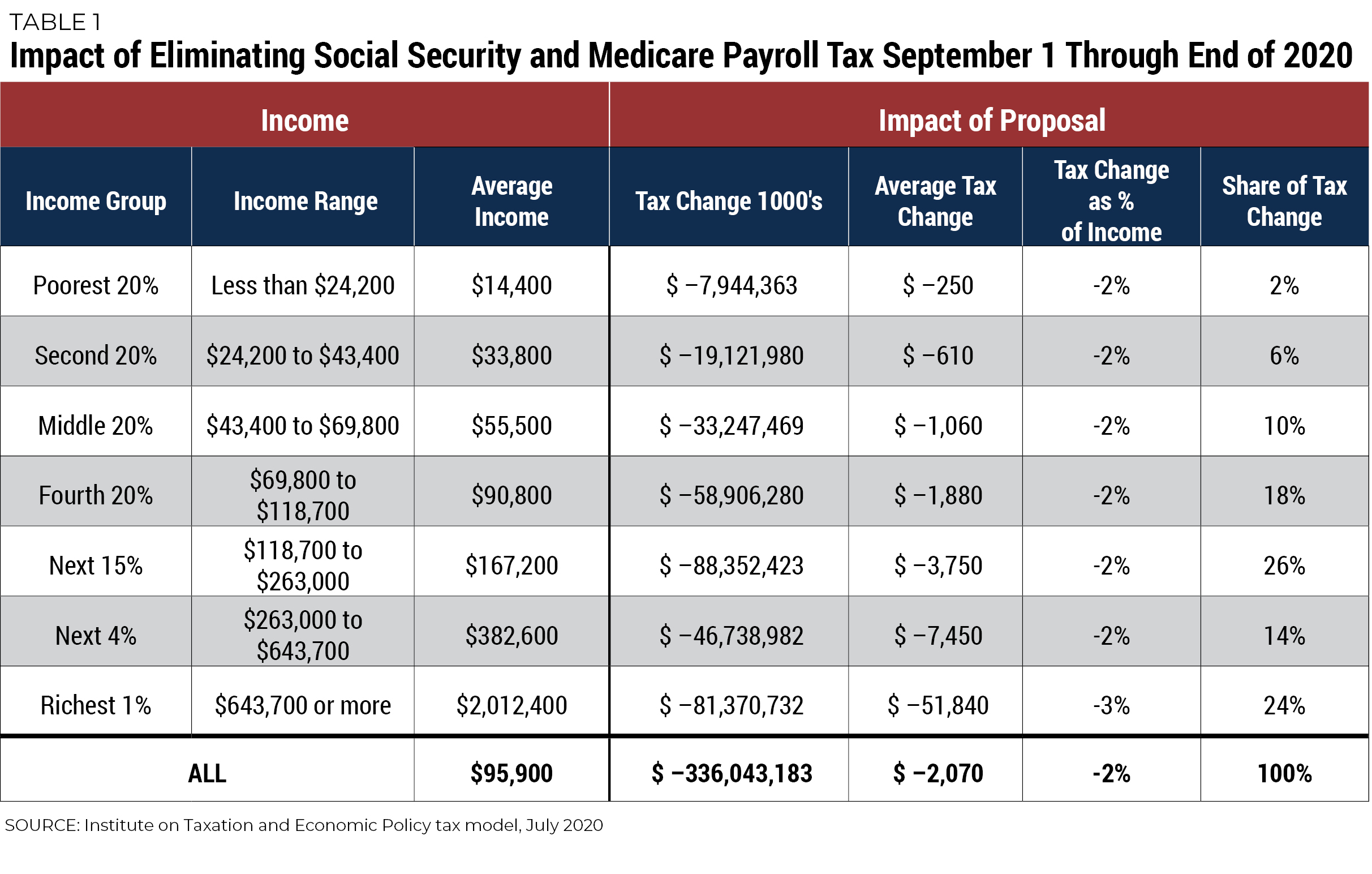

Medicare Withholding 2025 Threshold. For employees earning more than $200,000 in 2025, the additional medicare tax comes into play. The additional medicare tax is a.09% tax on taxpayers who make over $200,000 as individuals or $250,000 for married couples.

For 2025, the social security tax rate is 6.2% (amount withheld) each for the employer and employee (12.4% total). What benefit you’ll get back.

That are subject to medicare tax are subject to additional medicare tax withholding if paid in excess of the $200,000 withholding threshold.

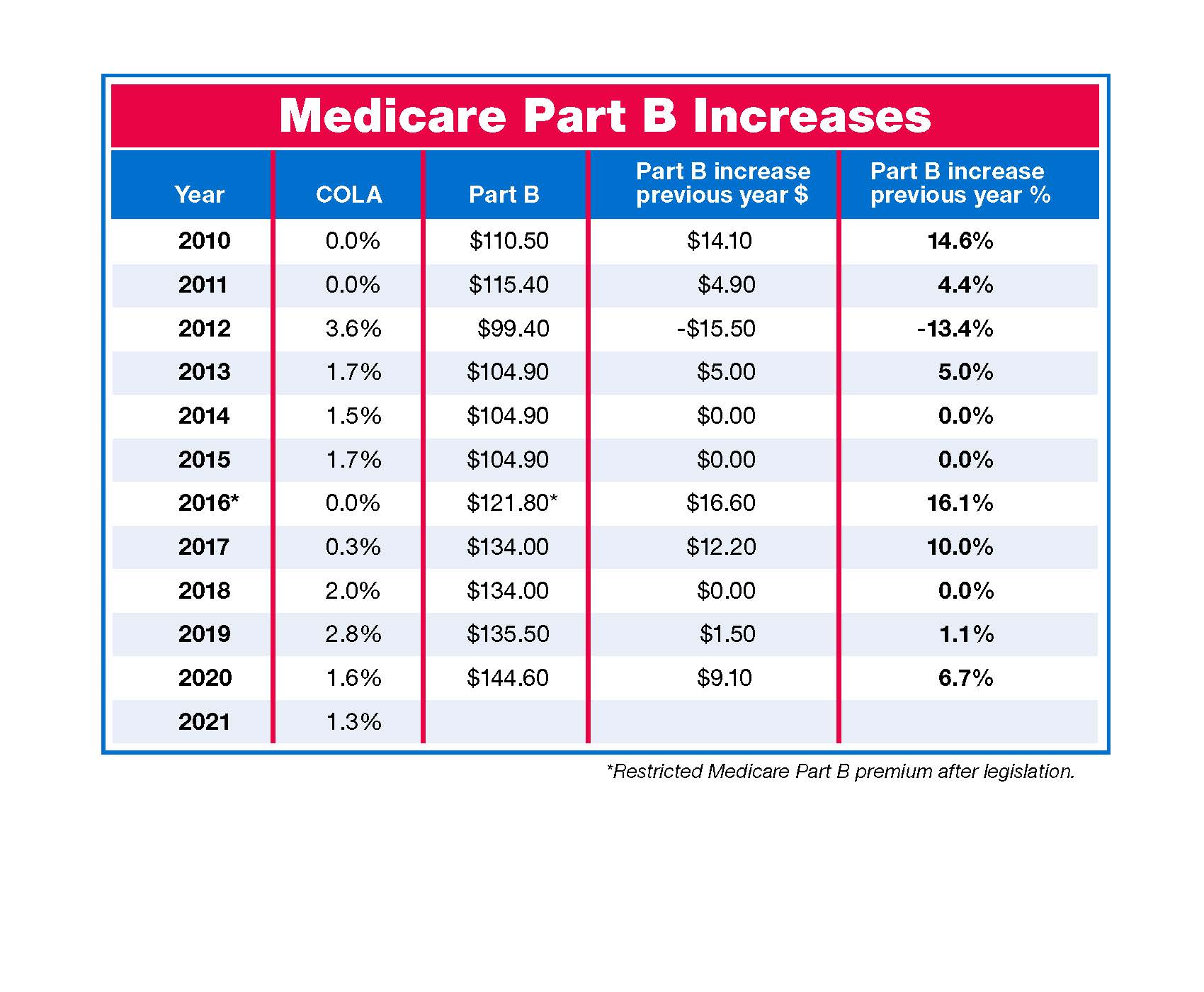

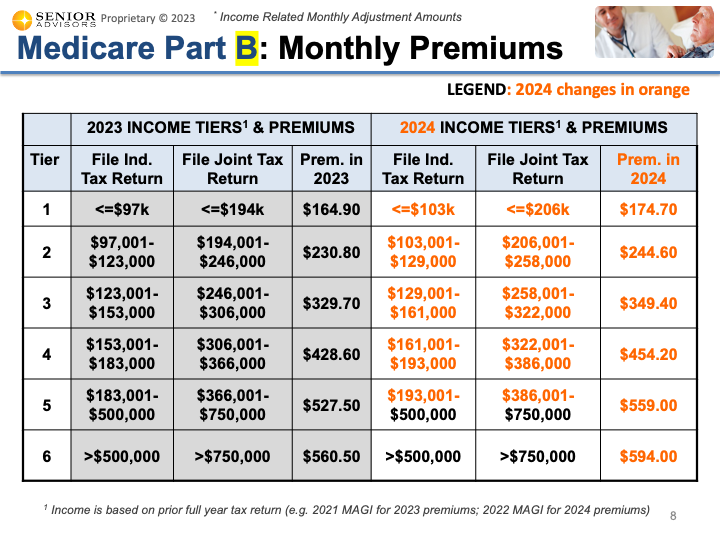

Medicare Tax Limits 2025 Meryl Suellen, The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2025. Use this information to work out which income threshold and mls rate apply to you.

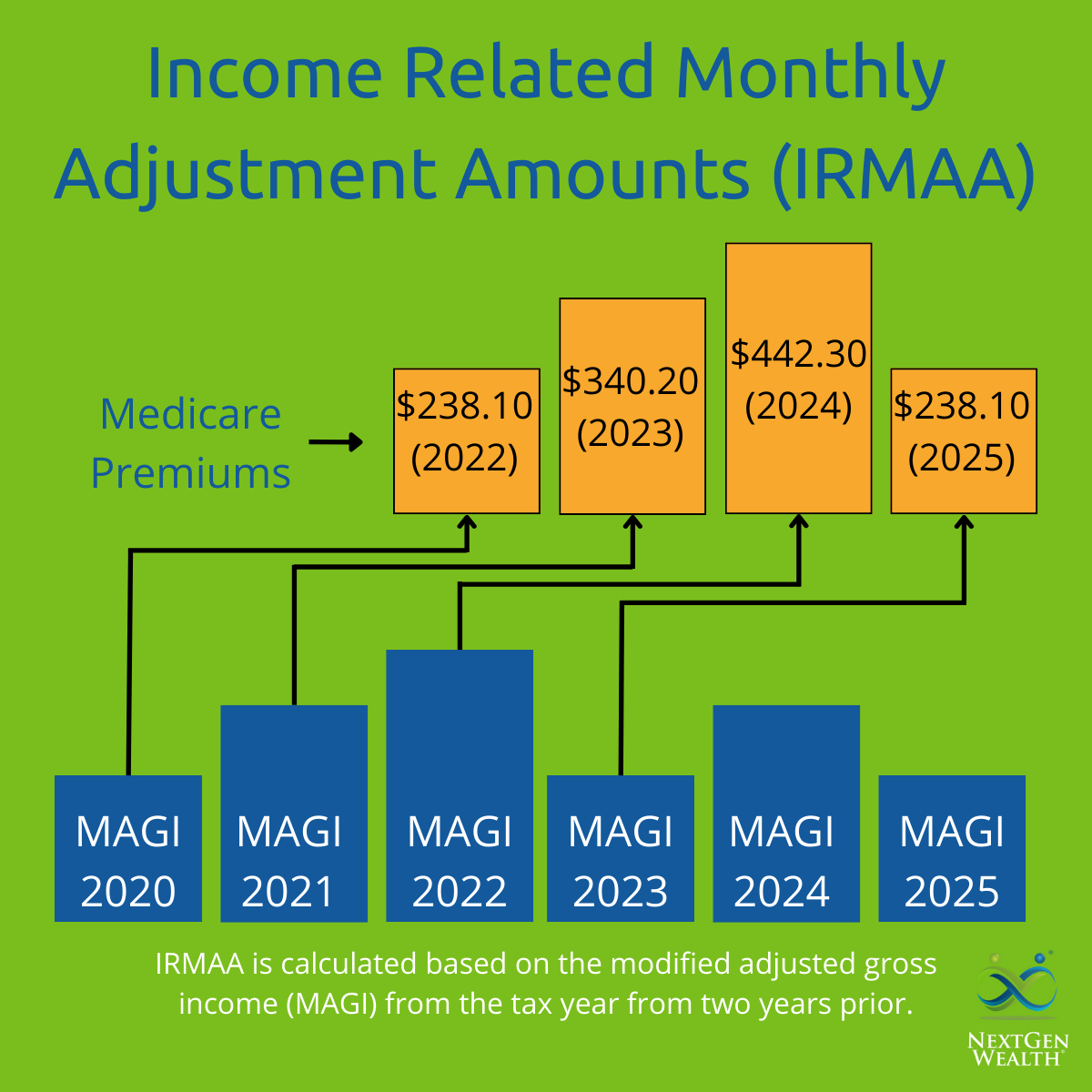

2025 Medicare Irmaa Brackets Liuka Prissie, There is an additional 0.9% surtax on top of the standard 1.45% medicare tax for those who earn over $200,000 (single filers), $250,000 (joint filers) or $125,000 (married. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Medicare Tax Calculator 2025 Myrah Tiphany, Residents enrolled in original medicare ( part a and part b) or a medicare advantage plan must pay a standard part b monthly premium of $174.70, an increase of $9. This involves a 0.9% surtax on top of the regular withholding rates.

Medicare Wage Limit 2025 Perri Brandise, The family income threshold is increased by $1,500 for each mls dependent child after the first child. However, if you make more than the preset income limits, you’ll pay more for your premium.

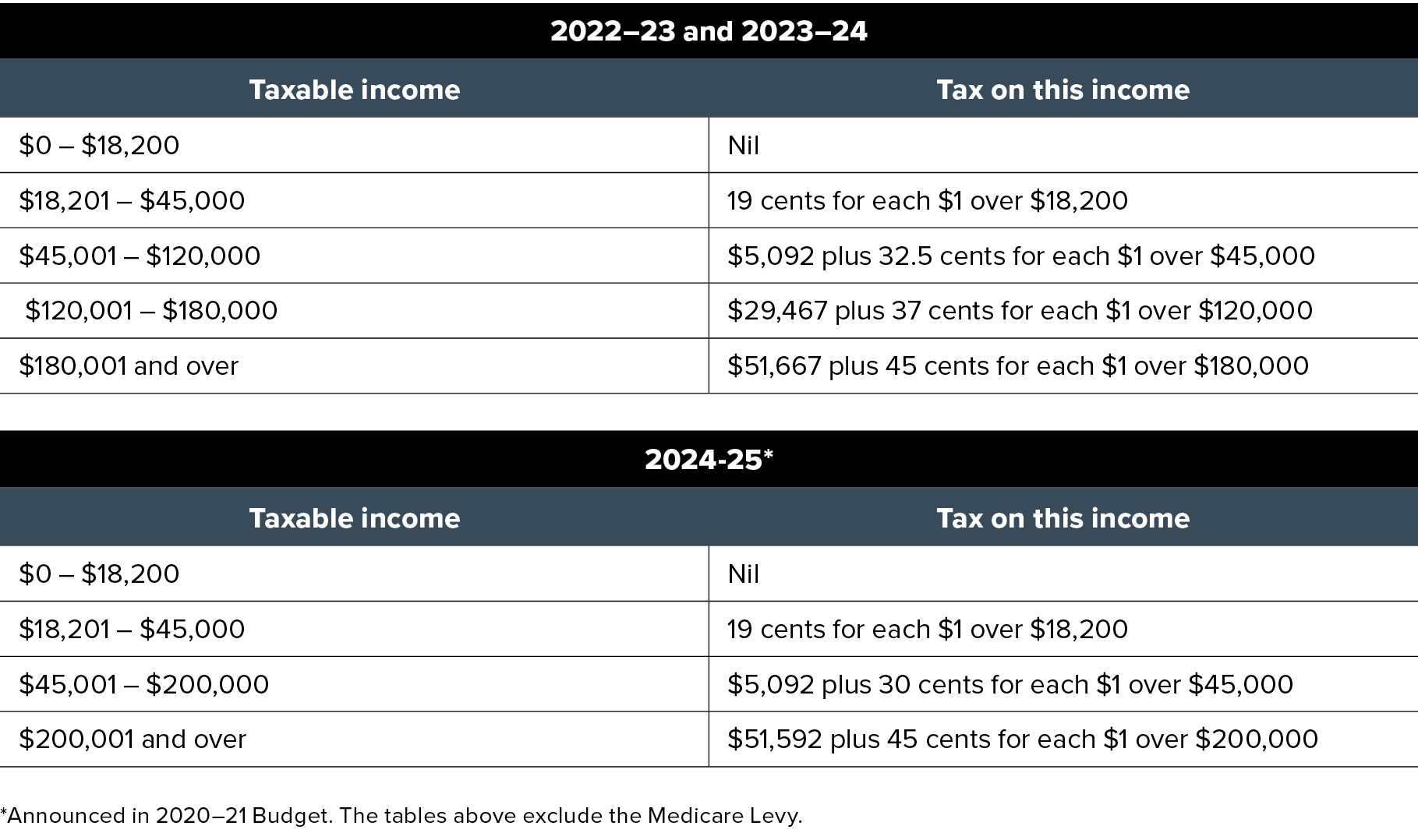

Federal Budget 202524 Personal tax Pitcher Partners, Monthly medicare premiums for 2025. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

2025 Maximum Medicare Tax Leia Roseline, The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2025. For 2025, the social security tax rate is 6.2% (amount withheld) each for the employer and employee (12.4% total).

Your Guide to 2025 Medicare Part A and Part B BBI, Residents enrolled in original medicare ( part a and part b) or a medicare advantage plan must pay a standard part b monthly premium of $174.70, an increase of $9. The family income threshold is increased by $1,500 for each mls dependent child after the first child.

What Is Medicare Withholding, In 2025, the medicare tax rate is 2.9%, split between the employee and their employer. It’s a mandatory payroll tax applied to earned income and wages, and.

2025 Tax Brackets Aarp Medicare Heda Rachel, There is an additional 0.9% surtax on top of the standard 1.45% medicare tax for those who earn over $200,000 (single filers), $250,000 (joint filers) or $125,000 (married. Modified adjusted gross income (magi) part b monthly premium amount prescription drug coverage monthly premium amount;

The 2025 IRMAA Brackets Social Security Intelligence, The increase in the 2025 part b standard premium and deductible is. For employees earning more than $200,000 in 2025, the additional medicare tax comes into play.

The fica tax rate, which is the combined social security rate of 6.2 percent and the medicare rate of 1.45 percent, remains 7.65 percent for 2025 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

Medicare recipients with 2025 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a premium between $244.60 and $594.00.